How does Oracle Cloud Human Capital Management Payroll work?

Payroll is important. Everyone likes to get paid on time and correctly, but there is a lot of work that goes into completing this task. The Oracle Cloud Human Capital Management (HCM) Payroll suite provides a variety of tools that allow for organizations to better manage their Payroll systems.

Before we dive into legislations and legislative data groups in Oracle Cloud HCM Payroll, let’s go over the basics of how the payroll in Oracle Cloud HCM.

Payroll integrates with the other sections of Oracle according to common business standards. This includes integration with the following:

- Benefits

- Cash Management

- Compensation

- Human Resources (HR)

- Subledger Accounting

Payroll receives information (inputs) from areas like HR, Compensation, and Benefits, and uses this data to transfer payment results into Cash Management for payment reconciliations and to post transfer journal entries to the General Ledger Cloud (outputs).

Payroll data is entered into the system by users given security access to sensitive data like federal and state tax statuses and exemptions, benefit enrollment options, and employee name changes.

Payroll data is also consolidated from different inputs into element entries and formulas for payroll result processing and ease of use. Think of the payroll process as following these five core steps:

- Establish a payroll definition.

- Calculate eligible elements for your organization’s payroll definition.

- Generate earnings, deductions, and tax amounts for each employee.

- View results on different reports and online pages to verify the accuracy of your calculations.

- Generate payslips.

Note: A payroll definition is a collection of parameters relating to payroll that your organization sets. These parameters include your payroll calendar and important days like your cut-off date, payroll processing date, and check date. Also included is your organization’s pay frequency, such as weekly, bi-weekly, or monthly.

When crafting your organization’s payroll, remember payroll definitions are limited to a single payroll period type, so if your organization distributes payroll weekly, bi-weekly, and monthly, you will need to build three different payroll definitions and their related elements for each.

At their most basic, payroll definitions establish your payroll period’s start, end, and cutoff dates, with room for adding costing information and other basic details.

Once you understand the basics, your organization’s HR Specialists and Implementers are ready to configure other elements of Payroll setup like organization structures, business units, and legislations and legislative data groups.

What’s the right task for handling legislations?

Legislations refer to payroll rules that are country or territory specific.

You will use the Manage Legal Entity HCM Information setup task to configure and correct country-specific payroll rules for countries and territories Oracle doesn’t already provide prebuilt rules.

Through this task, users can access the Configure Legislations page. This task also provides a chance for your organization to answer other business questions like the following:

- What’s your workday information?

- An organization’s workday is typically defined by its Work Start Time, Work End Time, Standard Working Hours, and Standard Working Hours Frequency.

- Do you use EEO reporting rules?

- Organizations with at least 100 employees or federal contractors with at least 50 employees are often required to complete an Employment Information Report (EEO-1) Report annually. This form collects information about your organization’s job categories and ethnicity, race, and gender information about your employees for the US Department of Labor.

- What are your organization’s federal payroll requirements?

- This is determined by whether your organization uses government contractors, the amount of employees your organization pays in a single pay period, and whether your organization uses a common ownership or centralized management organizational structure.

- What are your organization’s New Hire Reporting Rules?

- This information determines whether your organization needs to complete an EEO-1 Report or a VETS-4212 Report for organizations operating as federal contractors and subcontractors.

How do I implement legislations?

When creating and editing a user-defined legislation (not created by Oracle), the legislation has to be implemented into your payroll system. The Configure Legislations page organizes legislations into the following two types:

- Predefined: These are objects that already exist within the application that your organization is not required to define.

- Implemented: These are objects such as element classifications and balances that are designed for a specific territory or country.

Users are able to view payroll rules for predefined legislations, but they are prevented from modifying them. However, you are allowed to configure the following areas for implemented objects:

- Legislative rules

- Element classifications

- Payment types

- Component groups

- Balance dimensions

When determining who is affected by these objects, you are able to map person types in your Payroll system to payroll relationship types under legislative rules. When completing this mapping process, you choose between including Element Entries Only or the Standard option.

The Element Entries Only option is useful if you only use payroll relationships for element entries and no other reasons. This may be true if your organization gathers payroll data for a third-party payroll provider instead of handling payroll duties in-house.

The ability to modify payroll rules for legislations is dependent on the other payroll options you built. Consider the following limitations that can affect your payroll configuration:

- The following payroll elements cannot be modified:

- Your chosen Currency once you save a legislation because it would affect the balances you establish

- Your established Tax Year Start after running your first payroll

- The following payroll elements cannot be deleted:

- An element classification if you built an element in that classification

- A balance dimension if you built balances with that dimension

- A payment type if you built payment methods for that payment type

- A component group if you built calculation cards for that component group

What about legislative data groups and legal entities?

To further define your organization’s payroll practices, Payroll requires you create a legislative data group (LDG) to represent each country where your organization operates.

These groups contain country-specific information and include configurable elements like absence types, rates of pay, and, of course, payroll. An LDG acts as a legal reporting unit that supports the legal entity representing your company and designed by your team using the Oracle Cloud Enterprise Structure Configurator.

Oracle requires a company designs at least one legislative date group even when that company is not implementing Payroll. If you plan to configure Oracle Cloud HCM Workforce Compensation and/or Talent Management, you’re going to need to set a LDG up.

Also, LDGs are not shared across multiple enterprises, but the application will use them to separate payroll and other payroll-related data. Also, you are allowed to have multiple LDGs for the same country, but this requires entering information definitions again for each new LDG.

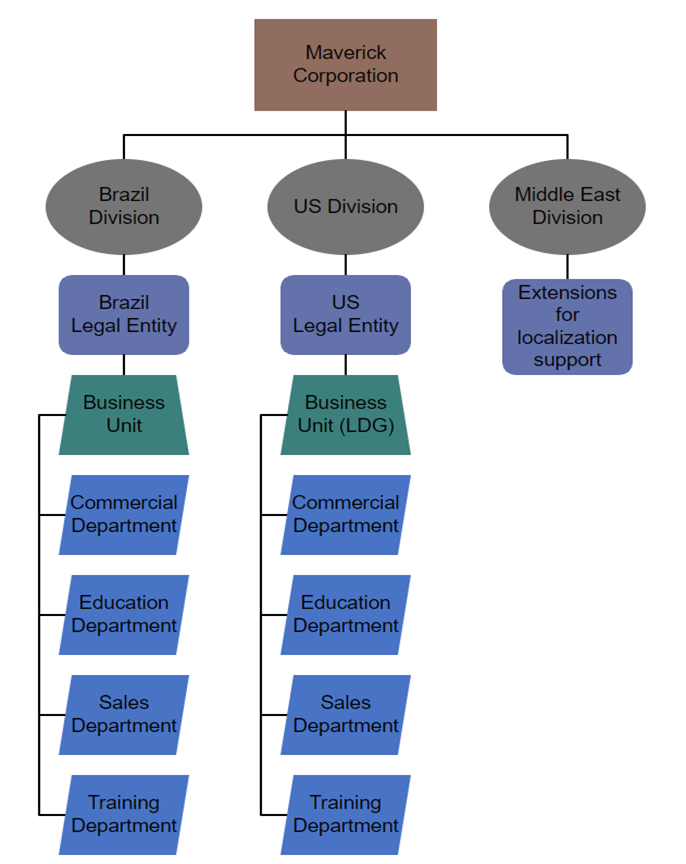

The following graphic provides a visual representation of how the Maverick Corporation is segmented and where the legislative data group is.

In this example, Brazil, the United States, and the Middle East region are under the legal entity Maverick Corporation and the United States and Brazil are both being represented by an LDG. Brazil is represented by a Brazilian legal entity and a business unit from the same tax reporting unit that is its LDG.

The United States is represented by a United States legal entity from the tax reporting unit and a business unit that is the LDG. The Middle East territories in this example contain only extensions for localization support.

Each LDG will contain one or more Payroll Statutory Units, which indicate when a fiscal year begins for your organization.

To create a new LDG, use the task Manage Legislative Data Groups task located in Oracle Setup and Maintenance. Each LDG created is associated with a legal entity representing your organization.

An LDG that processes payroll requires the following:

- A legislative code

- Currency

- Its own costing allocation key flexfield structure

When designing a new LDG, remember that the costing allocation key flexfield value cannot change after being created. This flexfield can be used across multiple LDGs because it can span across multiple jurisdictions as long as those jurisdictions are in the same country and have established legal entities that represent payroll statutory units.

Still have questions on legislations and legislative data groups in Oracle?

You should now understand how legislation affects your organization’s payroll and how to design legislative data groups to operate internationally.

However, knowing the basics of legislative data groups is only one element of Oracle’s HCM suite, and if your organization is large enough to operate internationally, there’s a good chance you will need to learn more about the Oracle HCM suite as a whole.

Maverick Solutions has training for the full suite of Oracle Cloud applications. With over thousands of training documents, users have access to training support for every business process.

You can access detailed walkthroughs on Oracle Cloud HCM Payroll processes and more with ENGAGE, Maverick Solutions’ comprehensive subscription-based training content on Oracle Cloud applications.

Offering fully customizable Training as a Service (Taas), Maverick Solutions can provide your organization:

- Training available anytime, anywhere

- Content that’s always current with software updates

- Interactive simulations

- Learning consultation to determine your organization’s training needs

To learn more about our fully customizable training services, speak with one of our training experts today!

The article was written for Oracle release 21C. Due to the nature of Cloud software and updates, this article may no longer be accurate. If you would like access to the most up-to-date version, please reach out to our team to learn more.