Revenue methods are used to calculate revenue amounts for contracts. In Oracle Project Portfolio Management Cloud, or Oracle PPM Cloud, revenue methods are applied to project contracts in order to recognize revenue. There are six different classifications of revenue methods in Oracle PPM Cloud.

So how do you create a revenue method in Oracle PPM Cloud?

You will use the Manage Revenue Methods task to create revenue methods in Oracle PPM Cloud. You can find this task by searching for the task in Setup and Maintenance, or you can use the functional setup manager to find the task in the Project Financial Management functional area.

Once you have navigated to the Manage Revenue Methods task, you will select the Create icon to create a new revenue method. Alternatively, you can search for existing revenue methods and edit them.[/vc_column_text][vc_column_text]

What do I need to know to create revenue methods in Oracle PPM Cloud?

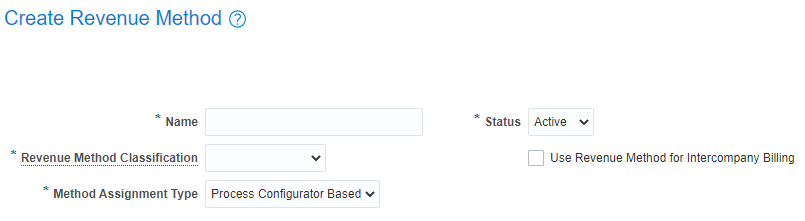

The required fields to create a revenue method are as follows:

- Name

- revenue method classification

- method assignment type

- status

The following screenshot displays the fields you will see on the Create Revenue Method page:

Note: You can name the revenue method anything that makes sense for your business. It is common practice to use the classification method as part of the revenue method name.

What are the revenue method classifications?

There are six revenue method classifications:

- Amount Based

- As Billed

- As Incurred

- Percent Complete

- Percent Spent

- Rate Based.

Amount Based

The Amount Based revenue method classification recognizes revenue as billing events are completed. You would choose an amount-based classification method when recognizing revenue for distinct events such as the sale of physical goods. For example, Company A would only recognize revenue from the sale of shoes once a customer has bought a pair of shoes.

As Billed

The As Billed revenue method classification recognizes revenue using a common set of bill rates, a burden schedule, or transfer pricing for both invoicing and revenue after invoices are finalized. You would choose an as billed classification method if amounts are likely to shift multiple times before an invoice is finalized.

As Incurred

The As Incurred revenue method classification recognizes revenue using a common set of bill rates, a burden schedule, or transfer pricing for both invoicing and revenue as costs are incurred. Using this method, revenue is recognized as soon as it is earned.

Percent Complete

The Percent Complete revenue method classification recognizes revenue based on estimated project progress. A billing event is created automatically based on the calculation formula defined in the revenue plan. Progress can be calculated based on associated project or contract line. You would choose this method to regularly recognize revenue throughout the length of a project.

Percent Spent

The Percent Spent revenue method classification recognizes revenue based on calculated project progress. Oracle divides actual cost to date over budget cost to determine project progress and recognizes revenue based on that calculation. A billing event is created automatically based on the calculation formula defined in the revenue plan. Progress can be calculated based on associated project or contract line. You would choose this method to recognize revenue as work is completed. For instance, if a project spans six months, but the bulk of the work is to be done in the first month, it would make more sense to recognize most of the revenue in the first month rather than evenly over the six months.

Rate Based

The Rate Based revenue method classification recognizes revenue similar to the As Incurred revenue method classification does. However, with rate-based revenue recognition, the set of bill rates, burden schedule, and transfer pricing for invoice and revenue do not have to match. The Rate Based revenue method classification is useful for as incurred revenue when invoice amounts are fixed or you are using a different burden schedule for invoice versus revenue. If you select the Rate Based classification method, you will also need to define the labor schedule type and the nonlabor schedule type. The options for these are bill rate, burden, and cost reimbursable.

What are the method assignment types?

There are two method assignment types:

- Process configurator based

- Extension based

Process Configurator Based

The Process Configurator Based method assignment type allows you to add assignments for revenue methods based on project processes. You can choose calculation level associated project or contract line and define how you want to group revenue based on transaction type.

Extension Based

The Extension Based method assignment type allows you to associate billing extensions with revenue methods to configure revenue calculation. The two billing extensions available are percent current revenue fee and percent ITD revenue fee. One calculates revenue based on the total of the billing event in the current invoice whereas the ITD (inception-to-date) revenue fee calculates revenue based on the total of all revenue to date minus the revenue already billed. The Percent Spent and Percent Complete classification methods can only be used with the extension based method assignment type.

Status and Intercompany Billing

When creating a revenue method you can set the status to active or inactive. You can also choose whether or not the revenue method will be used in intercompany billing. You would only select the Use Revenue Method for Intercompany Billing checkbox only if the revenue method will be used solely for intercompany contracts. Intercompany contracts use a rate based revenue classification method. You can also set the Extension assignments or Process configurator assignments to active or inactive.

When would I use Intercompany billing?

Say you own a company named ABCD. Company ABCD owns both the manufacturing company that makes the products and the retail stores that sell the products. While company ABCD ends up with all the profit, when the retail stores receive products to sell from the manufacturer, an intercompany invoice is created to track the movement. Depending on how the companies are setup, money may even be exchanged between general ledgers to track which financial assets lie with which company at any given time.

And that’s all the fields!

You have now created a revenue method in Oracle PPM Cloud.

How to recognize revenue for project contracts

Now that you have created a revenue method in Oracle PPM Cloud, you can generate revenue. You will need to use the Generate Revenue process to recognize revenue for project contracts. The generate revenue process recognizes project contract revenue according to contractual terms by creating revenue distributions, which are the source of revenue accounting entries.

To run this process, you will need to navigate to the Scheduled Processes work area and schedule a new process. The only required field when generating revenue is Business Unit. All other available fields are optional and help you narrow down which project you wish to generate revenue for.

However, you will note that Revenue Method is not an available field. So then, how do you use revenue methods in Oracle PPM Cloud? The revenue method is attached to a project during contract creation.

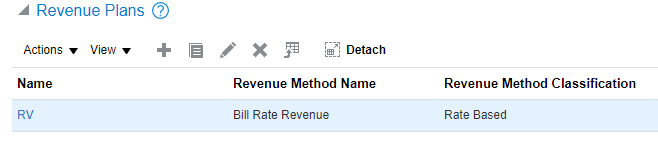

When you create a contract for a project, in the Billing tab, you need to add a Revenue plan. And a revenue plan needs a revenue method. The following screenshot displays an example of a revenue plan with a revenue method:

[/vc_column_text][vc_column_text]When creating a revenue plan, you will also setup the bill rate, burden schedule, or transfer pricing if the revenue method classification chosen requires those settings.

[/vc_column_text][vc_column_text]When creating a revenue plan, you will also setup the bill rate, burden schedule, or transfer pricing if the revenue method classification chosen requires those settings.

You have now created a revenue method and assigned it to a revenue plan to be used in a project contract. Now, when you run the Generate Revenue process the chosen revenue method will be used to determine the proper revenue amounts.

Summary

To create a revenue method in Oracle PPM Cloud, you need to navigate to the Manage Revenue Methods task. You can name the revenue method, choose whether it is active or inactive, then select the revenue classification method and the method assignment type. Once the revenue method is created, you need to create a revenue plan and attach the revenue plan to the project contract. You can then run the Generate Revenue process to recognize project revenue using the revenue method created.

If you need more assistance with revenue methods in Oracle PPM Cloud, Maverick Solutions has more in-depth training on Oracle Project Financial Management Cloud. One of our many interactive, step-by-step tutorials is called Configuring revenue methods. It guides you through to process to create a revenue method in a simulation of the Oracle user interface. Our practice tutorials allow you and your team to practice any process as many times as needed without affecting your production environment.

Have the revenue method creation process down? Our Project Financial Management course has over 200 process tutorials to help you and your team make the most of your Oracle PPM Cloud subscription.

Maverick Solutions’ Oracle Cloud Training subscription, or ENGAGE by Maverick Solutions, is all your team needs to increase user proficiency and adoption of Oracle Cloud applications. It is fully customizable, comprehensive, and available 24/7/365. If you want to know how Maverick Solutions can fit into your organization’s current or future Oracle projects, speak with one of our training experts today!